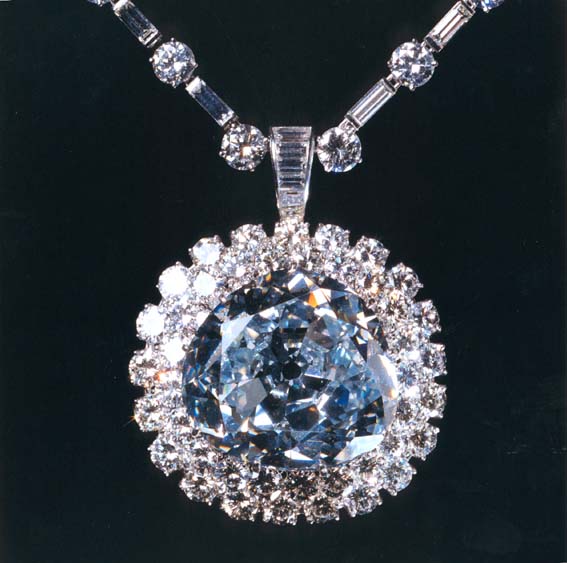

Image credit: Chip Clark

Chronological Background

1908 – Found at the Premier Mine, South Africa

1909 – 1910 – French jeweler Atanik Eknayan of Paris faceted the 30.62 carat heart-shaped, brilliant cut, blue diamond out of a 100.5 carat piece of rough

1910 – Cartier purchased the Blue Heart and sold it set in a lily-of-the-valley brooch to Mrs. Unzue, an Argentinian woman

1953 – Van Cleef & Arpels bought the gemstone and set it in a pendant to a necklace valued at $300,000. It was later sold to a European family

1959 – Harry Winston acquired it and mounted the Blue Heart in its present platinum ring setting surrounded by 26 round brilliant cut colorless diamonds with a total weight of 1.63 carats

Image credit: Chip Clark

1960 – Mrs. Marjorie Merriweather Post purchased the ring from Harry Winston

1964 – Mrs. Marjorie Merriweather Post donated the Blue Heart to the National Gem Collection, Smithsonian Institution, Washington D.C.

2010 – The Smithsonian celebrated 100 years since the cutting of the Blue Heart

Today, the Blue Heart continues to reside at the Smithsonian. Although the Blue Heart is about 2/3 the size of the Hope Diamond (45.52 carat), it remained a popular gemstone for its heart-shaped brilliant cut and vivid blue color. GIA graded the Blue Heart as a natural fancy deep blue diamond with a clarity grade of VS2.